Stanley Black & Decker, Inc. (SWK) stands as a paragon of industrial excellence and resilience, boasting a storied history that stretches back over a century. Renowned for its broad portfolio of tools, hardware, and security products, SWK has not only carved out a dominant position in the global market but has also demonstrated an unwavering commitment to shareholder value. Impressively, this commitment is underscored by its achievement of increasing its dividend for 55 consecutive years, an accomplishment that enshrines SWK within the elite group known as the Dividend Kings.

This distinction speaks volumes about the company’s financial health, operational stability, and the strategic foresight of its management team. In a world often rocked by economic uncertainties, SWK’s consistent dividend growth serves as a beacon of reliability for investors, offering a blend of growth and income that few companies can match. This track record of dividend excellence, combined with its innovative product lineup and strategic acquisitions, positions Stanley Black & Decker as a formidable player in the industrial and tools sector, poised for continued success and shareholder returns.

Analyst Ratings

- Michael Rehaut from JP Morgan maintains a “Sell” rating on the stock, adjusting the price target from $89 to $80, indicating a -10.45% downside as of Feb 6, 2024.

- Joe O’Dea at Wells Fargo maintains a “Hold” rating, changing the price target from $105 to $95, suggesting a +6.34% upside on Feb 2, 2024.

- On Dec 19, 2023, Joe O’Dea also maintained a “Hold” with Wells Fargo but adjusted the price target from $90 to $105, showing a +17.53% upside.

- Michael Rehaut downgraded the stock from “Hold” to “Sell” at JP Morgan with a price target of $89, predicting a -0.38% downside on Dec 14, 2023.

- Julian Mitchell from Barclays maintains a “Buy” rating, revising the price target from $120 to $105, which translates to a +17.53% upside as of Oct 30, 2023.

- Eric Lau at Citigroup upgrades the stock from “Hold” to “Strong Buy,” raising the price target from $110 to $118, pointing to a +32.08% upside on Oct 27, 2023.

Insider Trading

Over the last 6-12 months, insiders at SWK have actively managed their stakes through a series of buy and sell transactions, reflecting strategic moves within the company’s leadership. Notably, CEO Donald Allan Jr engaged in multiple sales post-exercise, with significant transactions on December 29, 2023, selling 420 shares at $98.45, and on December 16, 2023, offloading 1,075 shares at $99.80, indicating a capitalization on the exercised options for profit realization. Similarly, on December 6, 2023, Allan Jr sold 1,384 shares at $93.27, further adjusting his holdings while potentially taking advantage of stock price movements.

On the buying front, several insiders, including Andrea J Ayers (Chair), Jane Palmieri, and Mojdeh Poul, participated in contract buys on December 19, 2023, with transactions reflecting purchases at prices around $97.53, showcasing a vote of confidence in the company’s value. These purchases, alongside similar transactions by other executives like Adrian V Mitchell and Irving Tan, signal a collective insider belief in the company’s future prospects or an alignment of their financial interests with those of the company. Such insider activity, combining both acquisitions and dispositions, offers a nuanced view of the executive team’s engagement with their stock holdings, balancing between capitalizing on gains and investing in their company’s equity.

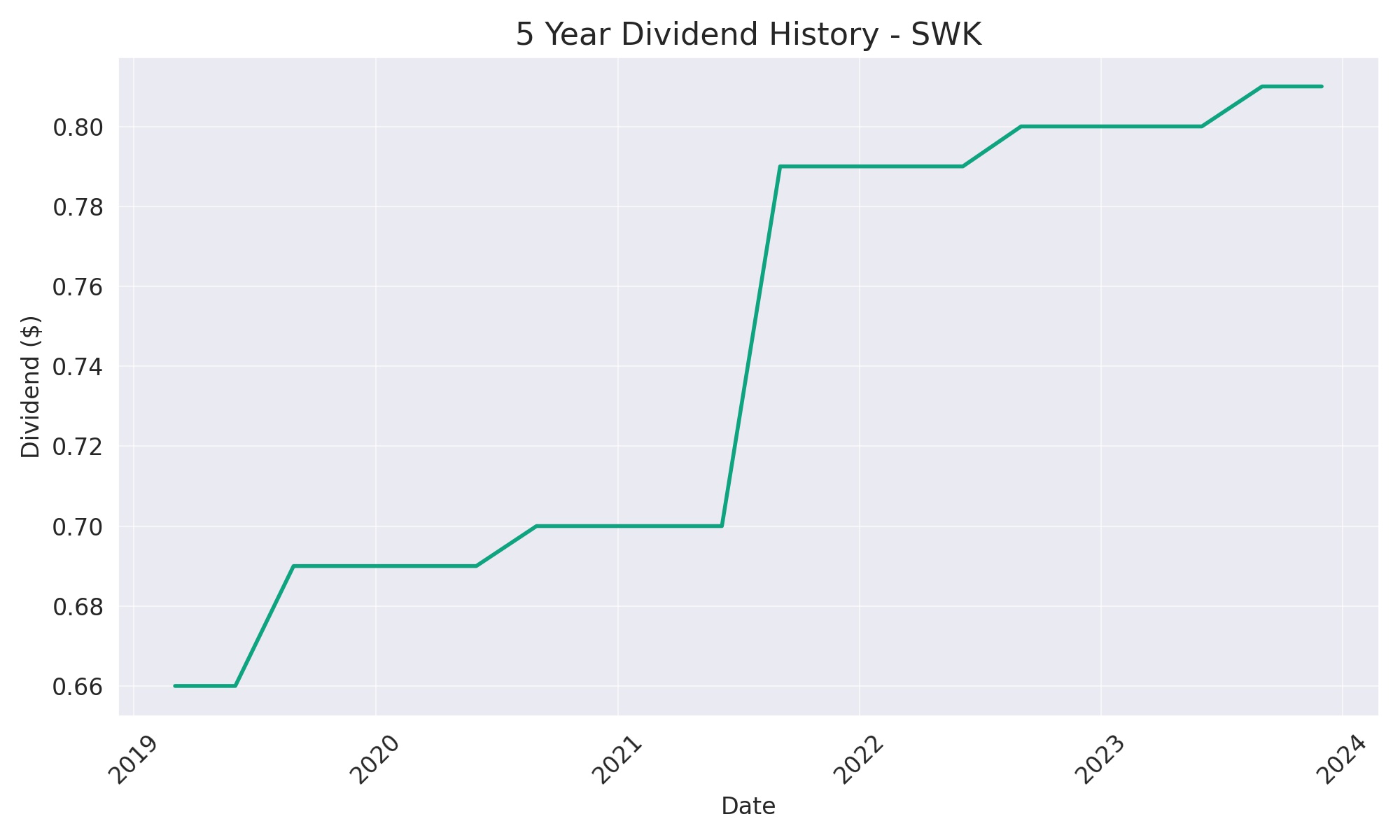

Dividend Metrics

Stanley Black & Decker, Inc. (SWK), renowned for its robust portfolio of tools and security products, exhibits a financial fortitude that has led to a consistent increase in dividends for 55 years, earning its regal status among the Dividend Kings. The company’s current dividend yield stands at a solid 3.4%, outpacing the five-year average of 2.4%, indicating a favorable trend for income-seeking shareholders.

This yield has grown by 6.38% over the past five years, showcasing SWK’s dedication to progressively rewarding its investors. Despite this positive dividend performance, the company’s one-year revenue growth presents a slight contraction of 4.00%, hinting at recent headwinds in sales. However, a hefty payout ratio of 300% may raise eyebrows, suggesting that the company is returning a substantial amount of earnings, perhaps even beyond its annual income, back to shareholders. This payout ratio may be incorrect and should be verified from another source. Still, the company managed to post a one-year return of 4.53%, reflecting a resilient stock performance amidst fluctuating market conditions. This juxtaposition of high dividend yield and payout ratio with a dip in revenue growth could signal a period of transition or an aggressive shareholder rewards strategy.

Dividend Value

Stanley Black & Decker, Inc. (SWK) presents an intriguing profile for value investors when scrutinizing the current dividend yield against its five-year historical average. The current yield of 3.4% notably exceeds the 5-year average yield of 2.4%, indicating that the stock may be yielding more ‘bang for the buck’ at present than it has on average over the past half-decade. This enhanced yield could signal an attractive entry point for dividend investors seeking to lock in higher income streams relative to the stock’s historical payouts. However, the elevated yield could also reflect a market price adjustment due to recent pressures, suggesting that while the dividend payout has remained attractive, the stock price has experienced some volatility, potentially offering a discounted purchase price for a stock with a historically strong dividend track record.

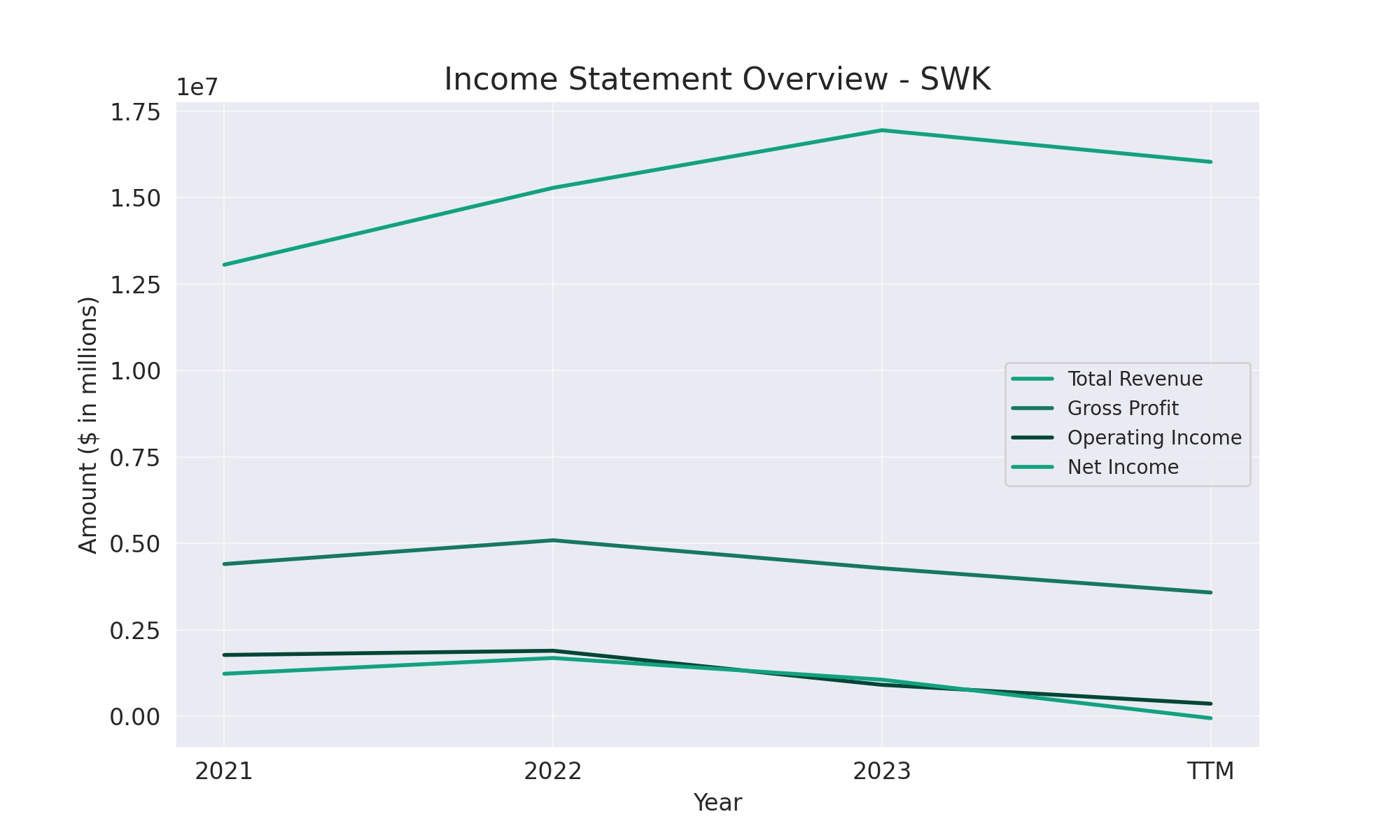

Income statement Analysis

In the financial tale of the past year, our protagonist, the stock with ticker symbol SWK, has spun a narrative of constrained revenue growth and challenging profitability. Total revenue took a modest step back from $16,947,400 to $16,031,400 in the trailing twelve months, like a reluctant tango dancer unsure of their next move. Meanwhile, the cost of revenue has played its own steady tune, resulting in a gross profit that pirouetted down from the higher notes of $4,284,100 to a more subdued $3,581,700.

The operating income, after accounting for the rhythm of operating expenses, choreographed a dip from $914,100 to $367,800, echoing the cautious steps of a company navigating a tightrope of economic uncertainties. The finale, net income available to common stockholders, saw a reversal from a hearty $1,062,500 to a lament of -$51,100, resembling a juggler who’s dropped a ball or two. It’s a plot twist that culminated in a diluted earnings per share that went from a robust $6.76 to a whisper of -$0.37. In this fiscal dance, it seems that SWK has had to sidestep some unexpected beats, leaving investors to wonder about the next rhythm in its financial choreography.

Balance sheet Analysis

The balance sheet of Stanley Black & Decker (SWK) tells a tale of assets and liabilities that might make even the most stoic of accountants raise an eyebrow. Total assets, the financial knights in shining armor, saw a retreat from $28,180,000 to $24,963,300, reminiscent of a knight deciding that discretion is the better part of valor. Yet, this is no damsel in distress story, as the total liabilities net minority interest seem to have followed suit, dialing back their siege from $16,587,600 to $15,249,100, as if realizing the castle walls were a tad higher than initially thought.

In the kingdom of equity, the gross minority interest’s coffers have decreased from $11,592,400 to $9,714,200. This is the part where the royal treasurer might clear his throat uncomfortably before breaking the news to the king. The working capital has shifted from a deficit of -$241,000 to a surplus of $1,405,500, echoing the classic tale of rags to slightly better rags. Meanwhile, the net tangible assets sit at a negative $3,265,400, painting a picture of a kingdom where the tangible treasures are outnumbered by the intangible dragons of goodwill and intellectual property. As the financial scrolls close on this period, SWK’s balance sheet story is one of asset consolidation and liability management, with a hopeful eye on future chapters.

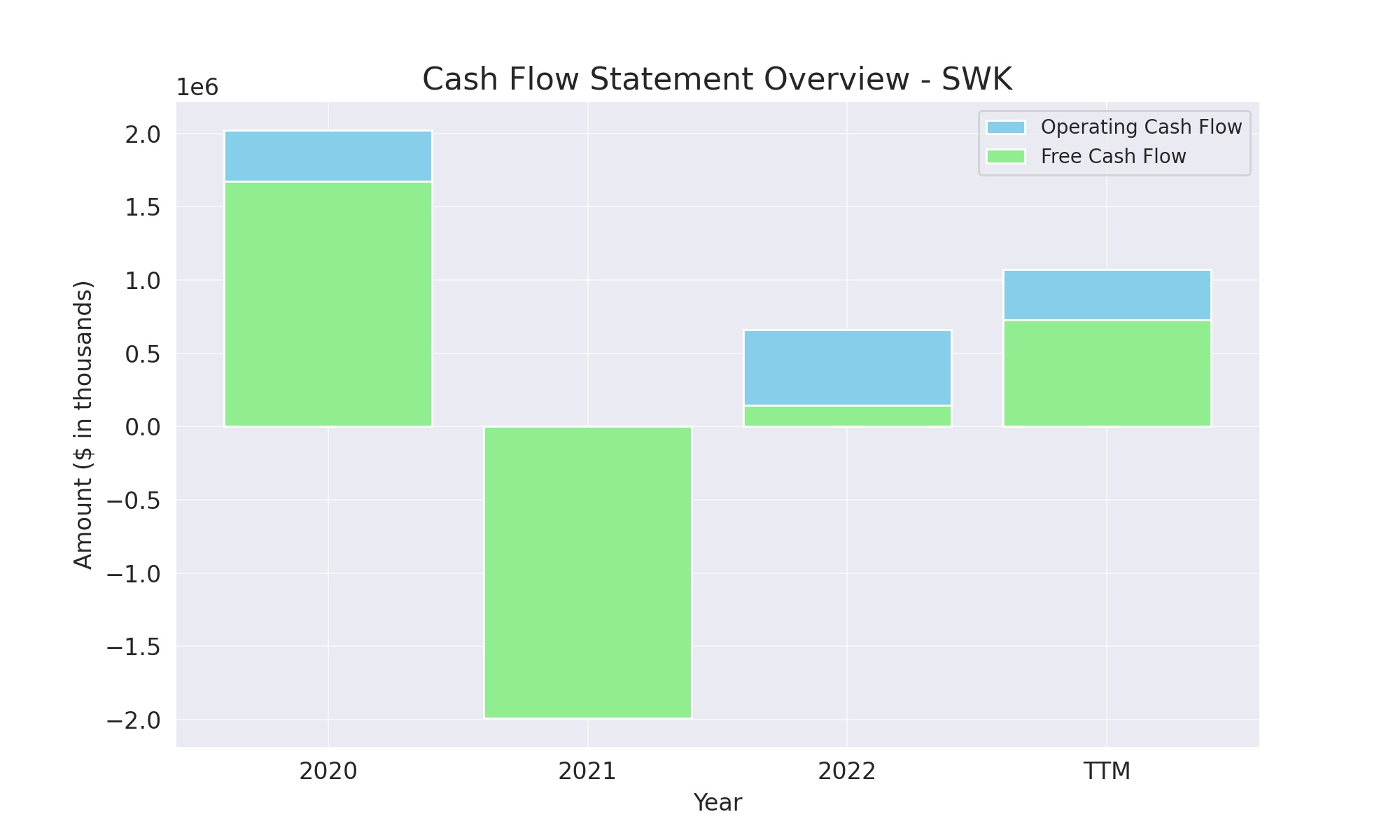

Cash Flow Statement Analysis

Peering into the financial ledger of SWK for the trailing twelve months, the operating cash flow seems to have made a commendable recovery, galloping to $1,073,100 from a previous year’s stumble into the moat at -$1,459,500. This could be the fiscal equivalent of finding a forgotten $20 in the laundry—pleasant, albeit slightly surprising. Investing activities, however, have taken a more conservative route, with an outflow of $331,400, suggesting that the company has been more of a careful squirrel than a spendthrift when it comes to shelling out for investments.

The financing cash flow danced a tango of its own, stepping back by $839,400, which might prompt some to wonder if the company is tightening its belt or just preparing for a different fiscal feast. Meanwhile, the end cash position, which might be seen as the company’s financial cushion, softened a tad to $316,900. A closer look at the capital expenditures reveals a disciplined approach, possibly akin to skipping dessert to save for a gourmet meal later. With the company navigating its financial currents with the precision of a seasoned captain, the free cash flow has waved a healthy $726,200 flag, indicating there might be smoother seas ahead for SWK’s cash reserves.

SWOT Analysis

A SWOT analysis of Stanley Black & Decker (SWK) reveals the following:

Strengths:

- Strong Brand Portfolio: SWK has a robust portfolio of recognized brands in tools and security, which drives customer loyalty and consistent sales.

- Diverse Product Offering: A broad range of products from hand tools to security solutions diversifies revenue sources and reduces dependency on any single market segment.

- Global Footprint: The company’s global operations allow it to tap into growth across different geographies and buffer regional market volatility.

Weaknesses:

- Operational Inefficiencies: Recent financials suggest potential operational inefficiencies that could be impacting profitability.

- High Level of Debt: A relatively high debt level compared to equity may constrain the company’s financial flexibility and increase vulnerability to economic downturns.

- Product Recall Risks: As a manufacturer, SWK faces risks related to product recalls that can lead to significant financial costs and damage to reputation.

Opportunities:

- Innovation and Technology: Investment in new technologies and innovation can lead to the development of new products, keeping SWK competitive and able to capitalize on market trends.

- Strategic Acquisitions: Acquiring complementary businesses could enhance SWK’s product line and expand its market share.

- Growth in Emerging Markets: There is potential for growth in emerging markets, where demand for tools and security products is increasing.

Threats:

- Intense Competition: SWK faces stiff competition in the tools and security market, which could pressure prices and margins.

- Economic Fluctuations: Economic downturns can reduce demand for SWK’s products, particularly in the construction and home improvement sectors.

- Supply Chain Disruptions: Global supply chain vulnerabilities pose risks to manufacturing and distribution, impacting operational efficiency.

In sum, Stanley Black & Decker’s well-established brand strength and global presence provide a solid foundation. However, the company must address operational challenges and leverage opportunities in technology and market expansion while navigating competitive pressures and economic uncertainties.

Competitors

Stanley Black & Decker (SWK) faces formidable competition from a range of companies that specialize in tools, hardware, and security solutions:

- Robert Bosch GmbH: A privately held German conglomerate, Bosch is a leading player in power tools and accessories, automotive components, and smart home products, competing directly with SWK’s offerings.

- Techtronic Industries Co. Ltd. (TTI): Known for brands like Milwaukee and Ryobi, TTI’s innovative cordless technology and aggressive growth strategy in the power tool segment make it a significant competitor.

- Makita Corporation: Originating from Japan, Makita is a prominent manufacturer of professional and consumer power tools, with a strong international presence and reputation for durability.

- Snap-on Incorporated: Specializing in high-end tools and equipment for professional use, Snap-on competes with SWK in the automotive and industrial sectors with its premium products and services.

- Fortive Corporation: Through its strategic acquisitions and focus on industrial technology and diagnostics, Fortive competes in several niches with SWK, particularly in the realm of engineered products and security.

These competitors challenge SWK across diverse fronts, from technological advancements in power tools to market penetration in the security and hardware sectors.