3 REITs Maintaining High Yields

Three different real estate investment trusts announced new dividend payouts. Each company has maintained a very high yield through recent years. Lets examine the dividend history and prospective growth of each REIT.

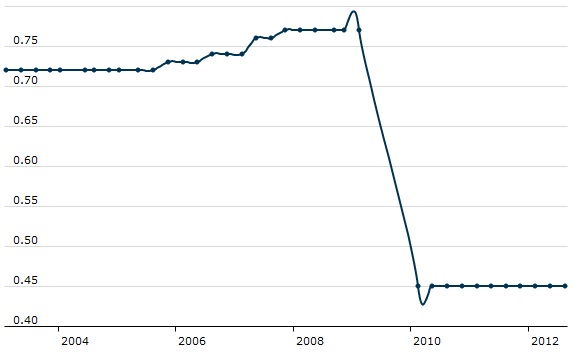

Hospitality Properties Trust (HPT)

Hospitality Properties announce a dividend of $0.45 per share that will be payable on August 22nd with an ex-dividend date of July 27th. This will be the company’s 12th consecutive quarterly dividend payout of $.45 per share since it suspended its dividend in 2009. Dividend growth has been lacking at the company which started paying dividends in 1995. The bright shining start for HPT is the 3 year net income growth rate of 15%. HPT has a dividend yield of 7.2%.

Here’s 10 year dividend history chart.

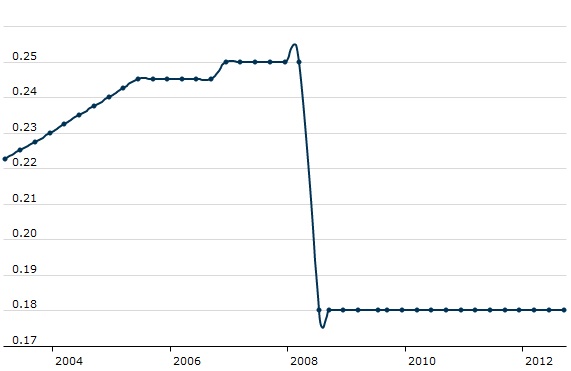

UMH Properties (UMH)

UMH Properties announced a dividend of $0.18 per share which will be payable on September 17th with an ex-dividend date of August 13th. UMH has a dividend yield of 6.4%. The company has been paying the same $.18 quarterly dividend since it cuts its dividend in 2008. UMH has a 3 year net income growth rate of 34%.

Below is a 10 year dividend history chart for UMH

CommonWealth REIT (CWH)

CommonWealth REIT announced a quarterly dividend of $0.50 per share payable on August 24th with an ex-dividend date of July 24th. Commonwealth started paying dividends to shareholders in 2010 and has not increased its dividend since it started paying dividends. We won’t show a chart for CWH, just picture a short flat line.

Let’s go REITs!

Each of these companies has been able to maintain its dividend but is showing no sign of dividend growth. Income is rising but dividends are holding steady.